What is a barndominium?

A barndominium is a type of residential structure that combines a barn and a condominium. It often features a metal building with living quarters.

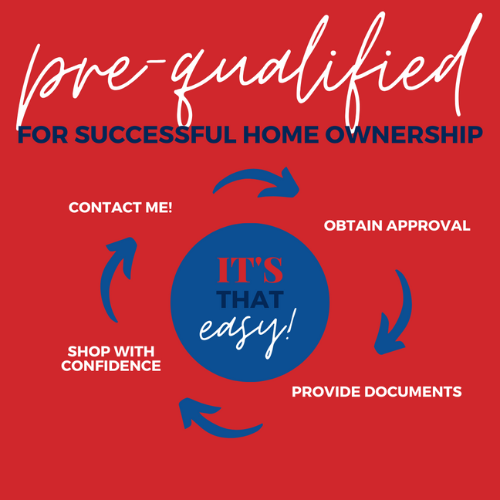

What is the 1st step in the process of securing funding?

Fill out the loan application completely first thing and this will go directly to Michael Bruegel, he will then call you to follow up on the information completed to discuss the loan and next steps with your builder.

Can I secure a traditional mortgage for a barndominium?

Yes here at American National Bank and Trust we can help with construction financing to build and can convert the loan to a permanent fully amortized loan.

What documents are required for a barndominium construction loan application?

Common documents include construction plans, cost estimates, proof of land ownership, and financial information such as a 2 year tax returns (all pages/all schedules), 2 years’ worth of W2’s, verification of credit (from your lender) and typically a 3 month supply of bank statements to show assets/reserves.

What is a barndominium construction loan?

A barndominium construction loan is a financial product that provides funds specifically for the construction of a barndominium or a home. It typically involves a draw schedule based on construction milestones and requires verification of credit, assets and income.

Is there a down payment requirement for barndominium construction loans?

Yes, lenders typically require a down payment for construction loans. The amount may vary, so it’s important to discuss this with your loan officer Michael Bruegel.

Are interest rates for barndominium construction loans different from traditional mortgages?

Interest rates for barndominium construction loans will vary based on down payment, loan term length, loan size and credit history. We have a couple of different lending options, its best to talk to Michael Bruegel about these programs.

Are there any restrictions on the use of barndominium construction loan funds?

Generally, funds from a construction loan are meant to cover construction-related expenses and it’s important to adhere to these guidelines

How do lenders assess the value of a barndominium during the loan application process?

Lenders may assess the value based on factors such as the land value, construction costs, and the potential resale value of the completed barndominium.

Can I use the land as collateral for the barndominium construction loan?

Yes, in many cases, the land where the barndominium is being constructed can be used as collateral to secure the construction loan. We would need to get plans and specifications (specs) of the barndominium and the appraisal will be ordered, which will include the total project future value.

Can I use a construction-to-permanent loan for my barndominium?

Yes, we offer construction-to-permanent loans, which convert to a traditional mortgage after construction is complete. This can simplify the financing process and we do offer a 1 time close option as well. Talk with Michael Bruegel to help determine the best loan option for you.